Best and most reliable crypto wallets will be discussed in this article. For purchasing, trading, and selling bitcoins, crypto wallets are a crucial tool. They are necessary for traders to safeguard and validate transaction information as well as store crypto safely. Custom crypto wallets provide traders with specialised solutions as opposed to those from crypto exchanges, whether they are hardware or software, also known as hot and cold storage.

Continue reading to find out more about the various kinds of bitcoin wallets, how they operate, and which one you ought to choose.

*We have included Public.com in this comparison table because some users seeking for cryptocurrency wallets are also looking for a cryptocurrency exchange. You power like to read our article on the Best Crypto Exchanges if you’re more interested in finding out where to buy and sell cryptocurrencies as well as the advantages and disadvantages of centralised vs. decentralised exchanges.

Top 9 Best and Most Reliable Crypto Wallets in 2022

Top 9 Best and Most Reliable Crypto Wallets are explained here.

1. Best for Beginners: Coinbase

PROS

- An interface that is easy to utilize & navigate

- Backs up over 44,000 digital assets

- Support for multi-signature and two-factor authentication

- Supported by a reliable trade platform that can recover misplaced or stolen property

CONS

- The same security flaws and shortcomings as other hot storage options

- Limited to mobile and tablet devices (except for Chrome extension)

Why we choose it: Coinbase Wallet is the best crypto wallet for beginners since it is simple to use, extremely safe, and supported by a reputable exchange. Also check

For those who are unique to crypto and have little to no experience, Coinbase Wallet is a great wallet. The software connects to the majority of major bank accounts and features a user-friendly interface with a welcoming three-tab structure and easily distinguishable functionalities. The greatest selection of currencies and tokens on our list, Coinbase Wallet supports over 44,000 different coins and tokens, including non-fungible tokens (NFTs) and digital collectibles. This is another crypto wallets.

Differentiating between Coinbase the exchange and Coinbase the wallet is crucial. One of the biggest cryptocurrency exchanges does not require an account to utilise the Coinbase wallet. Additionally, it is non-custodial, which means that your device stores the private key rather than Coinbase’s servers, so you don’t have to worry about your currencies being frozen for any reason or being vulnerable to a website hack. Also check blokada alternatives

Other noteworthy items are:

- Offers biometric authentication using the Secure Enclave chip found in Android, iOS, iPad, and Mac devices (e.g. FaceID, TouchID)

- Having access to in-app decentralised exchanges that can convert tokens without the use of middlemen

- Elective cloud backups that safeguard your digital keys

2. Best for Bitcoin: Electrum

PROS

- Quick and simple setup

- More secure than alternative hot wallets

- Transaction fees that can be altered

- Because of server setups, wallets never experience downtime

CONS

- Only permits trading in Bitcoin

– Inadequate setup and user interface for newcomers

- No live chat, email, or telephone assistance for customers

Why we selected it: Due to its vast security features and high degree of customizability, Electrum was selected as the best Bitcoin wallet.

Electrum is one of the oldest and best-known cryptocurrency wallets available today. It was founded in 2011. Additionally, Electrum is one of the few crypto wallets still in use that solely accepts payments in Bitcoin. Users can also modify their costs depending on how long they’re willing to wait for a transaction to complete: Pay more in fees, and your transaction will be done faster. The wallet hosts a mixture of potent security features that others lack.

The wallet’s usage of a lightweight client is one of its main advantages. Light clients can be set up quickly and take up less space on your computer than conventional wallet clients. The wallet only downloads a portion of the blockchain when utilising simple payment verification (SPV), accelerating transactions without sacrificing security. This is another crypto wallets.

Other noteworthy items are:

- Open-source wallet, which allows for code inspection and promotes safety and trust

- Custom transaction fees, which allow users to alter their costs based on how long they’re willing to wait for a transaction to finish, and other user account types

- Cold storage integration with hardware wallets (KeepKey, Ledger, and Trezor)

- Support for multiple signatures and two-factor authentication

3. Best for Mobile: Mycelium

PROS

- Acceptable with well-liked cold storage options (Ledger, Trezor, KeepKey)

- Single Address savings accounts and HD spending accounts are both offered.

- Educational resources and a crypto exchange within the app

- Provides offline payment options

CONS

- By nature, less secure than hardware wallets

- Novice users may find it confusing.

- Only accepts ERC-20 tokens, ether, and bitcoin

Why we chose it: Because of its strong emphasis on security and cutting-edge transaction history information, Mycelium is the finest crypto wallet for mobile devices in our opinion. This is another crypto wallets.

Another well-known crypto wallet with a strong emphasis on Bitcoin is Mycelium. It has been a mobile-only software wallet since it was first introduced to the market in 2008, and it is still one of the top choices for Android and iOS users.

Two of the wallet’s key features are the security and transaction choices offered by Mycelium. The software includes multiple levels of pin protection and is completely reproducible, meaning that any security flaws may be found by duplicating the code and comparing it to the original. The wallet app has multiple different user account types and configurable transaction fees with four suggested levels: low priority, normal, economy, and priority.

Other noteworthy items are:

- A sophisticated transaction history with details like block height, which is a specific place in the blockchain, miner fees, which are payments made to miners in the blockchain network, and inputs/outputs, which show addresses in a transaction.

- A watch-only option that enables customers to stop sending money while still monitoring their stocks and trades

4. Best for Offline Crypto Wallet: Ledger Nano X

PROS

- Supports a tremendous amount of digital assets

- Designed with unique hardware to safeguard your private keys

CONS

- Expensive compared to other cold wallets

- Some people might worry about their privacy if Bluetooth technology is used.

- Absent touchscreen

Ledger Nano X is the finest offline crypto wallet in our opinion because it supports a large variety of currencies, has good security standards, and supports mobile trading.

This is another crypto wallets. One of the most well-known plants of hardware wallets nowadays is Ledger. Its preferably wallet, the Ledger Nano S, a feature-rich and extremely secure cold wallet, ignited its early popularity. By containing a built-in battery and features like Bluetooth connectivity and improved asset management capabilities, the Ledger Nano X creates on the success of the Nano S.

The Ledger Nano X includes a 128 x 64-pixel screen for switching between apps and is presently available for $158.22. It has a matte black finish. One of the greatest numbers on our list, the wallet supports over 5,500 currencies and tokens and can handle up to 100 of them at once using the device’s apps. The Nano X can be used to swap crypto on the fly using the Ledger Live app on Android or iOS smartphones thanks to its Bluetooth Low Energy connectivity, which can be turned off at any time.

Other noteworthy items are:

- Ledger’s Secure Element chip, a specialised chip also utilised for high-end security solutions, including credit cards and passports, which defends against numerous forms of assaults.

- Using the Ledger Live app to lend and stake crypto to earn money is an option in addition to buying and selling crypto.

5. Best for Desktop: Exodus

PROS

- Backs more than 225 crypto assets

- Compatibility with the hardware wallets Trezor One and Trezor T

- Enables consumers to purchase Bitcoin using Apple Pay

- Constant customer service

CONS

- Exorbitant transaction costs on the in-wallet crypto exchange

- Some users may oppose to the lack of native 2-factor authentication.

- No support for multi-signature

Exodus is the best crypto wallet for desktops due of its quick transactions, user-friendliness, and wide range of client functions.

One of the most aesthetically attractive & user-friendly wallets available right now is Exodus. Exodus, which was formerly a desktop-only wallet, now has iOS and Android apps and is compatible with Trezor hardware wallets. This is another crypto wallets.

The variety of currencies that Exodus offers is one of its primary selling points. The wallet supports more cryptocurrencies than 225, which is higher than many other popular wallets. This covers well-known cryptocurrencies like Dogecoin and Shiba Inu as well as well-known meme coins like Ether, Litecoin, XRP, and Bitcoin Cash.

Other noteworthy items are:

- Customizable fees, but as of September 2021, only for Bitcoin transactions

- In order to speed up transactions, it uses SPV and runs on a light client, which means it doesn’t download entire blockchains.

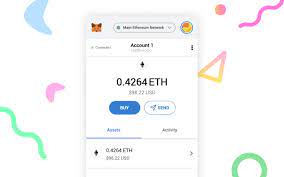

6. Best for Ethereum: MetaMask

PROS

- User-friendly interface designs for browser extensions and mobile apps

- May be connected to NFT markets

- Supports a large number of dApps

CONS

- Ether purchase costs can be significant.

- Unable to store Bitcoin directly

Thousands of tokens and decentralised applications are accessible over the Ethereum network thanks to MetaMask’s user-friendly interface, which is why we selected it as the best crypto wallet for Ethereum.

This is another crypto wallets. With more than 30 million active users each month, MetaMask is one of the most popular Ethereum wallets. The wallet allows users to engage with decentralised applications, or dApps for short, and may store and send cryptocurrencies that are compatible with Ethereum.

The wallet is available for download as an extension for users of the Google Chrome, Microsoft Edge, Mozilla Firefox, and Brave browsers. The MetaMask app is also available for download for Apple and Android mobile phones.

Additionally well known for its compatibility is MetaMask. Almost any blockchain network may be added to the wallet’s software, and it fully supports well-known Web3 networks as Polygon, Binance Smart Chain, and Avalanche. This indicates that users can immediately exchange a variety of digital assets through the wallet.

Other noteworthy items are:

- Developed using open-source code, which enables developers and security professionals to check the software’s security.

- Users maintain full control over their personal keys, and all account information is encrypted and stored locally with no contact with the MetaMask servers.

- Switch between layer 1 and layer 2 Web3 solutions rapidly.

6. Best DeFi Wallet: Crypto.com

PROS

- Select the trade charge and confirmation speed that you prefer.

- More than 250 different coins, such as BTC, ETH, CRO, ATOM, DOT, and LTC

- Receive interest on over 35 tokens.

CONS

- If you misplace your private key and recovery phrase, your funds are unreachable.

Geo-restrictions apply to the built-in token swap.

We selected Crypto.com as the best defi crypto wallet due to its wide range of decentralised financial instruments, first-rate onboarding procedure, and robust security architecture. This is another crypto wallets.

Users who are beginning their adventure towards decentralised finance should strongly consider using the Crypto.com DeFi Wallet. Additionally, they provide customers with 1-to-1 crypto exchange capabilities and access to a variety of passive income-generating tools for the crypto they currently own, benefits that are not available with traditional custodial wallets.

It’s crucial to distinguish between a custodial and non-custodial wallet, just like with other exchanges that offer both types. Users can download and utilise the Crypto.com DeFi Wallet for their regular crypto activity even if they don’t have an account on the exchange.

We also want to remind customers that using decentralised financial goods and services does come with a number of dangers, so they should exercise caution.

Other noteworthy items are:

- On iOS devices, Secure Enclave technology, 2-factor authentication, and biometric authentication are some of the levels of protection.

- The capacity to establish numerous digital wallets and import other wallets

- Utilize the WalletConnect tool to link up with other decentralised applications.

7. Trezor

PROS

- Select from the Trezor Model T or the more inexpensive Trezor One.

- Simple and practical interface

CONS

- More expensive than hardware wallets with comparable features

- iOS devices are not supported

This is another crypto wallets. Due to its release of the first hardware crypto wallets, Trezor is a well-known brand in the crypto community. Both of its current models support numerous assets and have excellent security features. It didn’t make our top list since Trezor’s models couldn’t compete with Ledger’s in terms of construction quality and the quantity of supported currencies. However, because to its optimal connection with Trezor models, we strongly advise Trezor for anyone who utilises the Exodus wallet as their primary crypto wallet. Also check Pimeyes

8. KeepKey

PROS

- Hardware wallet at affordable price

- QR codes can be displayed on devices.

CONS

- Only accepts a certain number of coins

- Heavier than competitors with similar price ranges

Another hardware wallet option is the KeepKey, which retails for $49.00 right now and is a great choice for individuals on a budget. Compared to the Trezor and Ledger wallets, it has a more user-friendly UI and appealing display. The wallet adheres to the highest security standards. When it came to the best offline wallet, KeepKey lagged behind the Trezor versions in some respects.

9. Atomic Wallet

PROS

- Backs more than 300 currencies and tokens

- Allows for in-wallet conversions and exchanges as well as credit card purchases.

CONS

- Hardware wallet integration is absent

- The atomic swap option has a limited number of coins available.

The hot storage wallet Atomic Wallet has a lot going for it. It is accessible to users without requiring them to create an account, offers round-the-clock customer service, and supports a sizable number of assets. One of its standout features is Atomic Swap, which allows users to exchange currencies directly within the wallet using a decentralised crypto exchange. Due to the fact that other wallets provided better versions of the majority of its functions, it was excluded from our list of the best cryptocurrency wallets. This is another crypto wallets.

Guide to Crypto Wallets

Transactions using digital currency are becoming more practical, useful, and accessible because to blockchain technology. However, as the digit of crypto users has increased, so too has the frequency of cryptocurrency-related cybercrime. It is therefore additional crucial than ever to have a highly secure crypto wallet, whether it be digital or physical.

A crypto wallet is what?

Traders keep the secure digital codes required to connect with a blockchain in cryptocurrency wallets, also known as simply “crypto wallets.” Contrary to what their name might mean, they don’t actively store your cryptocurrency.

Crypto wallets must communicate with the blockchain because they need to find the crypto linked to your address there. Since they serve as the owner’s identification and account on a blockchain network and give access to transaction history, crypto wallets are actually less wallets than they are ledgers.

How do crypto wallets function?

You aren’t actually transferring any coins when someone gives bitcoin, ether, dogecoin, or any other kind of digital currency to your crypto wallet. They are certifying that the crypto on the blockchain no longer belongs to their address but to yours by signing off ownership to your wallet’s address. To do this, you need a public key and a private key, two digital codes.

An automatic string of letters and numbers created by the provider of the crypto wallet is known as a public key. A public key can have the following format, for instance: B1fpARq39i7L822ywJ55xgV614.

Another string of numbers and letters, a private key is one that should only be known by the wallet’s owner.

Imagine a crypto wallet as an email address. You must provide your email address to others in order to receive emails. In the case of cryptocurrency wallets, this would be your public key, and you must share it with others in order to participate in any blockchain transaction. However, you would never divulge your email account’s password to a third party. That password is the equal of your private key for crypto wallets, which should under no circumstances be disclosed to anybody else.

Users of crypto wallets can take part in transactions without jeopardising the integrity of the currency being traded or of the transaction itself by employing these two keys. To establish any cash sent or received by your digital wallet, the public key issued to it must match your private key. The balance in your crypto wallet will change or remain the same when both keys have been validated. Also check CMovies alternatives

Types of crypto wallet

The two main varieties of cryptocurrency wallets are hot wallets and cold wallets. The primary distinction between them is that hot wallets are maintained online at all times, whilst cold wallets are kept offline.

1. Hot Wallets

Digital instruments known as “hot wallets” are always connected to the internet. They are bits of software that may be utilized to track & trade your currencies from your phone or desktop computer. You can use some hot wallets on a variety of devices because you can access them from your browser as well.

Hot wallets’ greatest perk is how convenient they are. Unless they’re restricted to a particular device, your public and private keys are saved and encrypted on the appropriate app or website for your wallet, making them accessible from anywhere with an internet connection. They are the best option for individuals who trade frequently and are considering spending bitcoins due to their accessibility.

Hot wallets are more weak to intrusions since they are always accessible online. The software that supports your wallet has flaws that hackers can take advantage of, or they can use malware to infiltrate the system. This is especially risky for web wallets run by crypto exchanges, which are generally bigger targets for crypto criminals.

PROS

- Extremely practical; accessible from any location with an internet connection

- More accessible than cold wallets in the case that you lose the private key

CONS

- Less secure than hard wallets and more susceptible to assaults of all kinds

Your keys for custodial wallets are stored on the exchange’s servers.

2. Unwarm Wallets

Your digital keys are kept offline on a piece of hardware or a piece of paper using cold wallets. You can purchase, sell, and trade crypto while a hardware wallet is linked to a computer. These wallets typically take the shape of USB drives. Your keys in “paper” wallets might be encoded on a piece of paper, printed as a QR code, or carved on a metal or other surface.

Cold storage wallets are purposefully made to be difficult to hack. Hackers are unable to remotely access the owner’s keys unless the wallet owner falls for a phishing scam. A burglar would need to steal the USB drive needed to access your crypto in order to utilise something like a hardware wallet, and they would then need to figure out how to unlock the drive’s password.

Due to the high level of security, wallet owners could make mistakes. If your private key is not safely stored elsewhere and you lose your USB drive or piece of paper, you are basically without access to your crypto. Due to the two-key security system, recovering access on a cold wallet is typically not possible in contrast to hot wallets, which allow for access recovery via a seed phrase.

PROS

- Due to offline storage, more secure than hot storage wallets

- Hot storage wallets support a lot of hardware wallets.

CONS

- On average, transactions take longer.

- Without a backup of your digital keys, recovering currency would be extremely difficult.

What to search for in a crypto wallet

It’s crucial to first ask yourself these questions before shopping for a crypto wallet:

How frequently do I trade? Do you plan to trade cryptocurrencies frequently or just occasionally? Hot wallets are preferable for active traders because of their efficiency and usefulness. However, by employing a cold wallet as a sort of savings account and keeping the majority of their currencies there, active traders may also gain from it.

What am I looking to trade? Are you looking to purchase and keep Bitcoin, or are alternative cryptocurrencies like stablecoins and altcoins more appealing to you? The crypto wallet you choose should support the currencies you want to trade and, ideally, be able to hold any additional coins you might want to trade later.

- What budget am I working with? Do you intend to amass a sizable amount of crypto in the future? Hardware wallets are perfect for this kind of activity, but unlike hot wallets (which are generally free), they need to be purchased up front. Hot wallets that offer quicker transfers or more functionality may have higher crypto trading costs.

What features should my wallet have? Do you have any specific plans for crypto that go beyond trading it? For instance, cryptocurrency traders who wish to stake, lend, and deposit their coins should look for wallets that support these functions.

After considering that, the following are some broad recommendations on what to look for in a crypto wallet:

- Supported currencies: Unless you’re interested in trading only Bitcoin, we advise using a wallet that supports at least a few of the more well-known altcoins, as the general rule of thumb is “the more, the better.”

- Accessible user interface – Whether you’re an experienced crypto user or a beginner, an accessible, intuitive user interface is always appreciated. Look for wallets that don’t require you to through a lot of hoops before you can begin trading basics.

- 24/7 customer assistance – Having customer support available all day is always a benefit, though it may be especially helpful for new traders. This is particularly true for wallets that frequently receive upgrades and can experience problems or visual issues.

- Compatibility with hardware wallets – Anyone who is considering cryptocurrencies seriously should think about purchasing a hardware wallet. Even those who don’t trade frequently should think about getting a hardware wallet to protect their most valuable possessions. Investors who have a hot wallet that is compatible with at least one hardware wallet brand are in a more suitable position since they can transfer their crypto back and forth as needed by defaulting to the model(s) that are supported by their wallet.

Judicious crypto investment

A brand-new and intriguing financial asset is cryptocurrency. Multiple people are drawn to the idea of a decentralised currency that is not dependent on the financial sector. The sudden price changes can be exciting, and some coins are just funny.

Think about the Dogecoin narrative. Dogecoin, a mashup of the words Bitcoin and Doge, the latter of which is a meme founded on a photo of a Shiba Inu puppy, was invented on December 6, 2013, by Billy Markus and Jackson Palmer as a joke. The money swiftly reached a market value of $8 million after becoming popular on the social network forums site Reddit. On May 8, 2021, DOGE reached a record high, surpassing a market capitalization of more than $90 billion as a result of attention from Elon Musk and Reddit users implicated in the GameStop short squeeze.

While amusing, it is nevertheless true that cryptocurrencies are erratic investments and have to be traded cautiously. When deciding whether to invest in cryptocurrencies, it’s crucial to take into account the risks listed below. :”

The value of cryptocurrency fluctuates. A quick check at Bitcoin’s historical pricing reveals enormous peaks and valleys over the course of its existence. Only recently, in May 2021, did Bitcoin drop by 53 percent after reaching a high of $64,000 for a unmarried coin in April. The same is true for any other significant cryptocurrency. These abrupt changes are not typical when contrasted to how quickly mainstream assets develop.

Nothing is backing crypto. Most coins don’t base their worth on any natural resources. They lack government support and don’t track business development potential the way equities and bonds do. This raises the overall volatility of cryptocurrencies. Due to their high price volatility, speculative assets like cryptocurrencies have a higher level of risk. Their value is expected to rise significantly in the near future, ideally before a crash, and many active vendors invest in them with the aim of generating a large profit.

Crypto is uncontrolled. Do we need specific legislation to control crypto assets? is a question that governments and institutions throughout the world continue to debate. Who ought to oversee crypto? Should it even be regulated? Consumers are not adequately protected from numerous crypto-related crimes and scams, despite the fact that this lack of regulation reflects the nature of crypto and its spirit of freedom. Ultimately, given that its future is still unknown, crypto must be properly analysed and handled.

Experts in personal finance advise investing no more than 5% of your portfolio in volatile securities like crypto. Beginners should also avoid riskier crypto trading strategies like lending and staking money to make money.

Crypto Glossary

- Blockchain: A blockchain is a record of ledger that duplicates itself throughout its whole network of systems and records digital transactions. Blockchain’s shared architecture generates an immutable registry that shields consumers from fraud. The blockchain is used to trade cryptocurrencies.

- BTC: The symbol for Bitcoin’s money. Satoshi Nakamoto developed Bitcoin as the first decentralised cryptocurrency. To learn more, read our article on Bitcoin.

- Foundation for Wallet Interoperability (FIO) Network: The FIO was founded in the “pursuit of blockchain usefulness through the FIO Protocol,” which aims to increase the blockchain’s scalability and create a common framework for communication between diverse crypto-related businesses.

- Hierarchical Deterministic (HD) account: HD accounts can be recovered on other hardware by employing a backup phrase made up of 12 unrelated words that is generated when the wallet is established.

- Light client: Light clients, also known as light nodes, use SPV, a technology that eliminates the requirement to download the entire blockchain in order to verify transactions. A whole blockchain could range in size from 5GB to over 200GB, depending on the currency. As a result, light clients typically operate more quickly than standard clients and use less CPU, disc, and bandwidth. Light clients are nearly always used by mobile wallets.

- mBTC: A millibitcoin is a unit of currency equal to one thousandth of a bitcoin (0.001 BTC or 1/1000 BTC).

- Multi-signature: Also known as multisig, this functionality allows wallets to send and sign transactions using several private keys.

- Open-source: Software that is deemed to be “open-source” has a source code that anybody is free to examine, alter, or distribute. Programmers modify a piece of software’s functionality using the source code.

A seed is a 12- to 24-word string produced by a crypto wallet. It is advised that users write down this phrase and keep it in a secure place because it contains all the information required to regain access to their wallet and money.

Recent Information about Crypto Wallets

As the cost of Bitcoin starts to rise from its agonising lows earlier this year, investors are questioning if the crypto meltdown is truly over. Late in July, cryptocurrency prices rose to over $24,000, prompting experts to wonder if they have reached a bottom. Given this proverbial light at the end of the tunnel, financial gurus continue to warn investors against irrational spending in crypto.

Due to the prevalence of online phoney crypto app frauds, crypto investors should exercise the same level of caution with their holdings as before. According to a study from the FBI, cybercriminals are thought to have stolen $42.7 million from 244 Americans. In order to construct fraudulent apps that look authentic, these criminals frequently deceive users by copying brand names, logos, and other identifying information from legitimate crypto trading platforms.

FAQ for Best Crypto Wallet

Which crypto wallets are the best?

The best cryptocurrency wallets offer a balanced combination of user-friendly features and security tools at an affordable price. Our analysis shows that Electrum, Coinbase, Ledger, Exodus, and Mycelium are some of the top cryptocurrency wallets.

We examined over 15 cryptocurrency wallets and gave them grades for their security, usability, and price. We had to assess some criteria differently for hot and cold crypto wallets because they have various types. For instance, it is difficult to determine the cost of using a hot wallet due to fluctuating exchange, network, and wallet fees, whereas cold hardware wallets are tangible goods that must be purchased from a store.

The wallets on our list performed well in the following areas:

- Safety – When it comes to crypto wallets, safety is our first priority. We preferred wallets with two-factor authentication, biometrics, support for multiple signatures, open-source code, and robust transaction security procedures.

- Features – The general functionality of each wallet is the emphasis of features. We gave higher ratings to wallets that have more traded assets, live charts, staking and lending options, and compatibility with hardware wallets.

- Price – The price of a crypto wallet varies by wallet type. We preferred hot wallets with exchanges that charged less for transaction processing and cold wallets that were competitively priced. We also gave configurable transaction fee wallets some thought.